First Data Merchant Services Things To Know Before You Buy

Wiki Article

Getting The Ebpp To Work

Table of ContentsEbpp Fundamentals ExplainedOnline Payment Solutions - The Facts8 Easy Facts About Merchant Services ExplainedWhat Does Credit Card Processing Do?All about Credit Card Processing FeesLittle Known Facts About Payment Hub.The Definitive Guide for EbppThe 2-Minute Rule for First Data Merchant ServicesGetting My First Data Merchant Services To Work

The B2B repayments space is rather crowded. A number of banks, fintech companies, as well as industry specialists provide B2B settlements systems, as well as new companies are getting in the space regularly. We examined out the alternatives, as well as right here are several of the finest B2B settlement options: Finest for: B2B organizations who purchase or market on net terms.9% handling cost (similar to what Pay, Chum as well as Square fee for charge card payments). The purchaser has 60 days to pay Fundbox, passion totally free. After 60 days, the purchaser can extend terms for as much as one year, for a flat once a week fee. There's likewise checkout capability with Fundbox Pay.

The smart Trick of Comdata Payment Solutions That Nobody is Talking About

Fundbox Pay's B2B options basically move the danger of the purchaser not paying away from the vendor. This is similar to using bank card in the customer area. When a person mosts likely to a restaurant or buys a movie ticket with a charge card, the seller earns money today, as well as the customer delays payment for a billing cycle.

An Unbiased View of Virtual Terminal

Best for: B2B organizations that make use of invoices to bill their customers or pay their suppliers. Pay, Chum is a heavyweight in the B2B repayments industry. When utilizing Pay, Friend for these repayments, you can send a customized invoice via email to another organization. All they have to do is click the "pay" button, as well as they can pay with their Pay, Friend balance, a connected savings account, or a credit score or debit card.

Getting My Credit Card Processing Companies To Work

Quick, Books is among the biggest names in local business, best recognized for their audit software program. Quick, Publications additionally supplies a B2B repayment remedy that works in a similar way to Square and also Pay, Pal. find here You can find out here email invoices to clients, with instantaneous notices when the consumer views as well as pays the invoice.Best for: B2B buyers that wish to streamline repayments with a credit scores card. An one-of-a-kind entrant in the B2B settlements room is Plastiq. One reason that handling B2B repayments is challenging is that various vendors like various repayment techniques. One supplier may request ACH transfer, while another requests for cable transfer.

Payment Solutions Fundamentals Explained

Trade, Gecko is an inventory and order management company, but additionally uses robust B2B settlements services. They also supply a settlement entrance for wholesale purchasers.

8 Easy Facts About Credit Card Processing Companies Explained

Whichever B2B payment option you pick, the majority of local business proprietors locate themselves on the paying end as well as getting end. Here are some finest practices when you're the customer: Clear your accounts payable balance by paying right after the deal. Utilize a bank card to pay if you need more time to fix up the expense.Use your positive repayment history to discuss beneficial terms with new providers (merchant services). Right here are some finest practices when you're the seller: Send an invoice or settlement request right after the purchase. Adhere to up with pleasant reminders as the payment deadline nears. Enforce due days as well as late charges to ensure your consumers pay in a timely manner.

Rumored Buzz on Ebpp

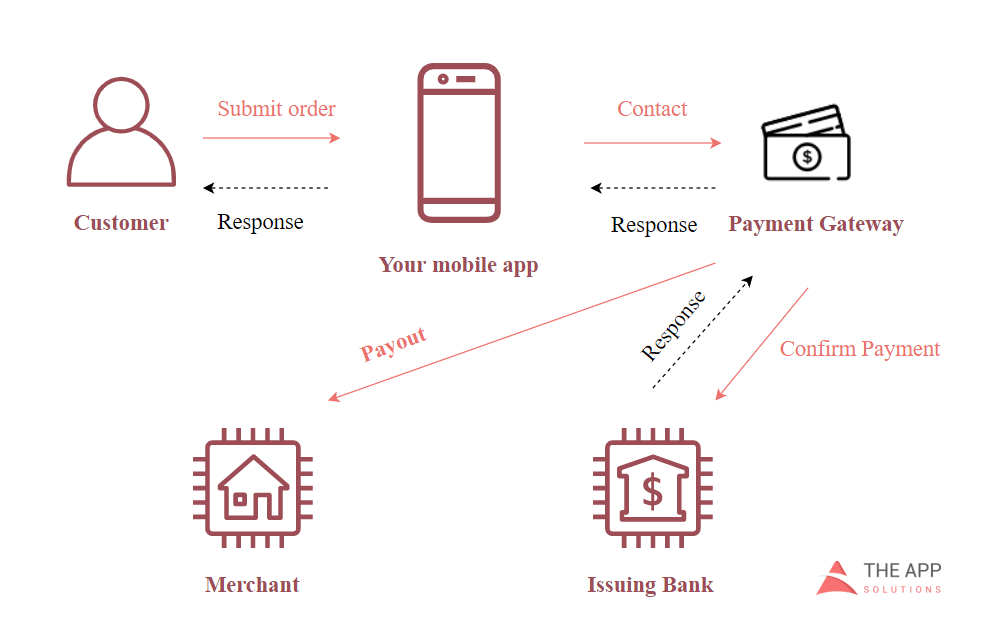

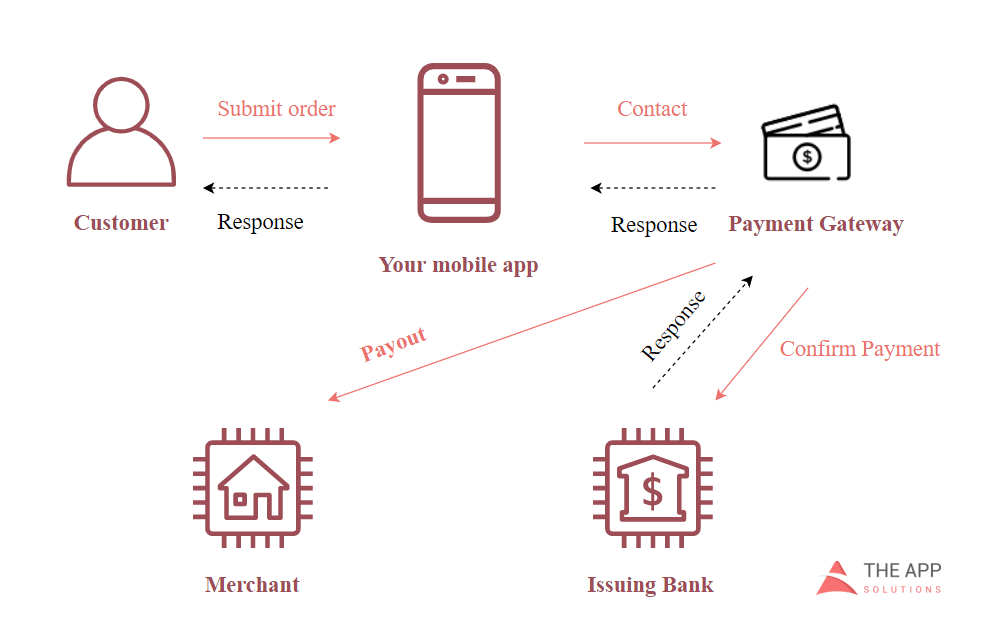

What do payment processing business suggest when they claim "repayment stack?"Simply placed, a settlement pile is all the components additional info needed to create an online settlement service.What are the Components of a Settlement Stack?"The term "settlement pile' is made use of to refer to all the technologies as well as parts that a company uses to accept repayments from customers.

Facts About Payeezy Gateway Revealed

These are several of the components of a settlement pile that work with each other to create a frictionless business experience for companies, banks as well as consumers. Fraud Prevention, As technology proceeds to proceed, fraudulent activity remains to advance. It should come as no shock that retailers and also various other companies are experiencing even more information breaches than in the past.It's ideal to keep a document of every purchase within the company by utilizing audit software, but likewise outside of the business. This is done by checking records with the banks that tape the purchases. If a blunder is made, simply align your company's records with bank declarations to find the source of an error.

Merchant Services Fundamentals Explained

Checkout User interface, An excellent checkout user interface makes it very easy for clients to see rates in their local money and to discover as well as utilize their recommended local repayment methods. The checkout interface is a crucial element of your web site experience and also important for seeing to it you do not shed consumers that want to purchase from you.Report this wiki page